kern county property tax calculator

The offices of the Assessor-Recorder Treasurer-Tax Collector Auditor-Controller-County Clerk and the Clerk of the Board have prepared this property tax information site to provide tax. This estimator will assist taxpayers who have either recently purchased a property or those considering a purchase during the current fiscal year July 1st - June 30.

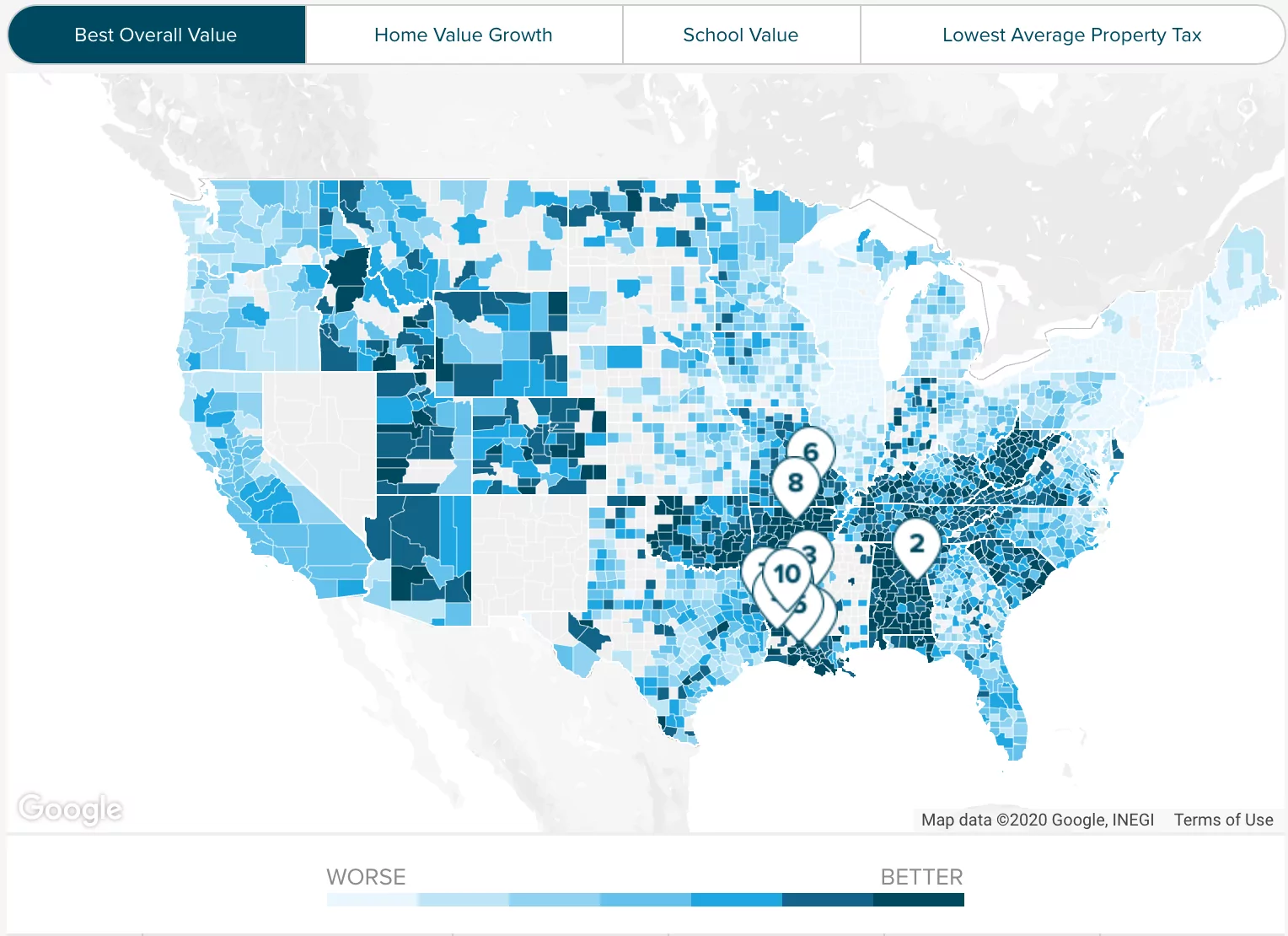

Property Tax By County Property Tax Calculator Rethority

The first installment is due on 1st.

. The median property tax also known as real estate tax in Kern County is 174600 per year based on a median home value of 21710000 and a median effective. Members can use KCERAs Online Benefit Estimator to estimate their monthly retirement benefit. Kern County CA property tax assessment.

Uncover Available Property Tax Data By Searching Any Address. 661 868 3485 Phone The Kern County Tax Assessors Office is located in Bakersfield California. Taxation of real property must.

Secured tax bills are paid in two installments. The median property tax on a 21710000 house is 227955 in the United States. File an Exemption or Exclusion.

Kern County Treasurer-Tax Collector mails out original secured property tax bills in October every year. This is equal to the median property tax paid as a percentage of the median home value in. California Property Tax Calculator.

Change a Mailing Address. Lake Isabella Mortgage Calculator. This calculator can only provide you with a rough estimate of your tax liabilities based on the.

Bakersfield California 93301. GENERAL INFORMATION Property Tax Portal. The median property tax on a 21710000 house is 160654 in California.

Find Property Assessment Data Maps. Auditor - Controller - County Clerk. I hope you find this website informative and helpful and that you return regularly to see what is happening in our office.

Ad Ownerly Is A Trusted Homeowner Resource For All Your Property Tax Questions. The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100. Alta Sierra Arvin Bakers Air Park Bakersfield 1 Bakersfield 2 Bakersfield 3 Bear Valley Bodfish Boron Buttonwillow California City China Lake.

The first installment is due on 1st. The median property tax on a 21710000 house is 173680 in Kern County. Ad Get a Vast Amount of Property Information Simply by Entering an Address.

1 be equal and uniform 2 be based on current market worth 3 have one estimated value and 4 be considered taxable if its not specially exempted. Get driving directions to. 800 AM - 500 PM Mon-Fri 661-868-3599.

In our calculator we take your home value and multiply that by your countys effective property tax rate. Auditor - Controller - County Clerk. Method to calculate Kern County sales tax in 2021.

1115 Truxtun Avenue Bakersfield CA 93301-4639. Request a Value Review. Kern County Treasurer-Tax Collector.

Kern County Treasurer And Tax Collector Search results will not include owner name. The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800. To avoid a 10.

Payments can be made on this website or mailed to our payment. File an Assessment Appeal. The benefit amount displayed will reflect the information inputted.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required. This convenient service uses the latest technology to provide a secure way to bid on tax defaulted property. Property Tax By County Property Tax Calculator Rethority File an Assessment Appeal.

1115 Truxtun Avenue Bakersfield CA 93301-4639. With easy access to. Full cash value may be interpreted as market value.

The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100. You Can See Data Regarding Taxes Mortgages Liens Much More. The median property tax on a 21710000 house is 227955 in the United States.

Kern County collects on average 08 of a propertys assessed fair. To use the calculator just enter your propertys current market. Welcome to the Kern County online tax sale auction website.

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Property Tax By County Property Tax Calculator Rethority

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Property Tax By County Property Tax Calculator Rethority

Kern County Treasurer And Tax Collector

California Sales Tax Calculator Reverse Sales Dremployee

Riverside County Ca Property Tax Calculator Smartasset

Sacramento County Ca Property Tax Search And Records Propertyshark

Kern County Treasurer And Tax Collector

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Santa Clara County Ca Property Tax Calculator Smartasset

California Vehicle Sales Tax Fees Calculator

Kern County Treasurer And Tax Collector

San Diego County Ca Property Tax Search And Records Propertyshark

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Image Result For Realtor Mls Logo Realtor Mls Hawaii Real Estate Realtor Logo