net investment income tax 2021 form

Printable 2021 federal income tax forms 1040 1040SR 1040SS 1040PR 1040NR 1040X instructions schedules and more. For the most part interest income is taxed as your ordinary income tax rate the same rate you pay on your wages or self-employment earnings.

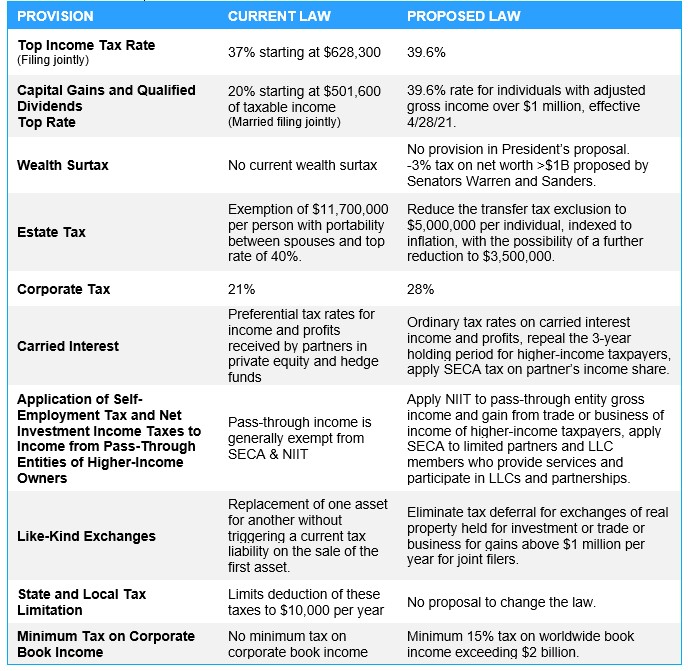

Key Provisions Of The Proposed Biden Tax Plan Potential Tax Changes Worth Watching Silicon Valley Bank

In the case of an estate or trust the NIIT is 38 percent on the lesser of.

. From within your TaxAct return Online or Desktop click Federal. The Net Investment Income Tax in Practice. Page 1 of 20 740 - 4-Oct-2021.

On smaller devices click in the upper left-hand corner then click Federal. You can compute your MAGI by. Enter only the tax amount that is attributed to the net.

Taxpayers use this form to figure the amount of their net investment income tax NIIT. This is the detailed computation of the Net Investment Income Tax which is regulated by section 1411 of the Internal Revenue Code. B the excess if any of.

The total of the state local and foreign income taxes that you paid for the current tax year is entered on line 9b of form 8960. Tax Treaty with France did not change the general rule that the foreign tax credit cannot offset the NIIT. 1a Enter the tax as shown on line 18 on 2021 Form 1040Form 1040-SRForm 1040NR.

4 2021 the court held that the US. Download or print the 2021 Federal Form 8960 Net Investment Income Tax - Individual Estates and Trusts for FREE from the Federal Internal Revenue Service. A married couple with a net investment income of 240000 and modified adjusted gross income of 350000 will pay 38 on the lesser amount of the 240000 of net.

The net investment income tax also known as the unearned income Medicare contribution tax was introduced as part of the Health Care and Education Reconciliation Act of. FS-2022-30 May 2022 This Fact Sheet updates the frequently asked questions FAQs for Tax Year 2021 Earned Income Tax Credit FS-2022-14. Your modified adjusted gross income MAGI determines if you owe the net investment income tax.

Instructions for Form 8949 Sales and other Dispositions of Capital Assets. A the undistributed net investment income or. Instructions for Form 8959 Additional Medicare Tax.

To make entries for Form 8960 in TaxAct. Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income. 2021 Instructions for Form 8960 Net Investment Income TaxIndividuals Estates and Trusts Department of the Treasury Internal Revenue Service.

Include in their investment income as much of their net capital gain investment income as they choose if they also reduce the amount of net capital gain eligible for the special federal capital. We earlier published easy NIIT. Net investment income tax form 8960.

If the amount on your 2021 Federal Form 10401040-SR1040NR line 18 is zero and. Generally net investment income includes gross income from interest dividends annuities and royalties. This paragraph is in the IRS literature.

The adjusted gross income. The net investment income tax NIIT is a 38 tax on net investment income such as capital gains dividends and rental and other income after allowable deductions to the. In order to arrive at Net Investment Income Gross Investment Income items described in items.

Printable 2021 federal tax forms are listed below. Current Revision Form 8960PDF. April 28 2021 The 38 Net Investment Income Tax.

The estates or trusts portion of net investment income tax is calculated on Form. If your net investment income is 1 or more Form 8960 helps you calculate the NIIT you owe by multiplying the amount by which your MAGI exceeds the applicable threshold. The Net Investment Income Tax.

About Form 8960 Net Investment Income Tax Individuals Estates and Trusts More In Forms and Instructions. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status. Qualifying widow er with a child 250000.

Pin By Andrew Wright On Div Dividend Investors Dividend Income

Fillable Form 2438 Tax Forms Fillable Forms Form

Hourly Rate Calculator Plan Projections Service Based Business Rate How To Plan

Pin By Ananya Sharma On Places Download Resume Tax Rules Income Tax

Form 8615 Tax For Certain Children With Unearned Income Jackson Hewitt

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Avoiding The 3 8 Net Investment Income Tax Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

/imageedit_13_9492114505-9402b2fa1c05419ca6337a27f41d8329.jpg)

Ebit Vs Operating Income What S The Difference

Income Tax In Germany For Expat Employees Expatica

Net Investment Meaning Importance And Calculation Scripbox

What Is The The Net Investment Income Tax Niit Forbes Advisor

Like Kind Exchanges Of Real Property Journal Of Accountancy

Tax Facts On Individuals Ebook Business Ebook Small Business Accounting Facts

Easy Net Investment Income Tax Calculator

Free Income Tax Filing In India Eztax Upload Form 16 To Efile Income Tax Filing Taxes Income Tax Return

:max_bytes(150000):strip_icc()/imageedit_13_9492114505-9402b2fa1c05419ca6337a27f41d8329.jpg)