car lease tax deduction calculator

Guaranteed maximum tax refund. Enter the cars MSRP final negotiated price down payment sales tax length of the lease new car lending rate and the cars value after the lease ends.

Is It Better To Buy Or Lease A Car Taxact Blog

To calculate the deduction for professional use of your car using the standard mileage method simply multiply your business miles by the amount per.

. Here we discuss the tax deduction rules for a purchased and leased vehicles by a business owner-manager. Vehicles costing 30000 or less are eligible for. If the lease agreement for your passenger vehicle includes such items.

Vehicle Expenses 7000 x 60 4200. To compute the deduction for business use of your car using Standard Mileage method simply multiply your business miles by the amount per mile allotted by the IRS. Lease Tax Deduction Calculator.

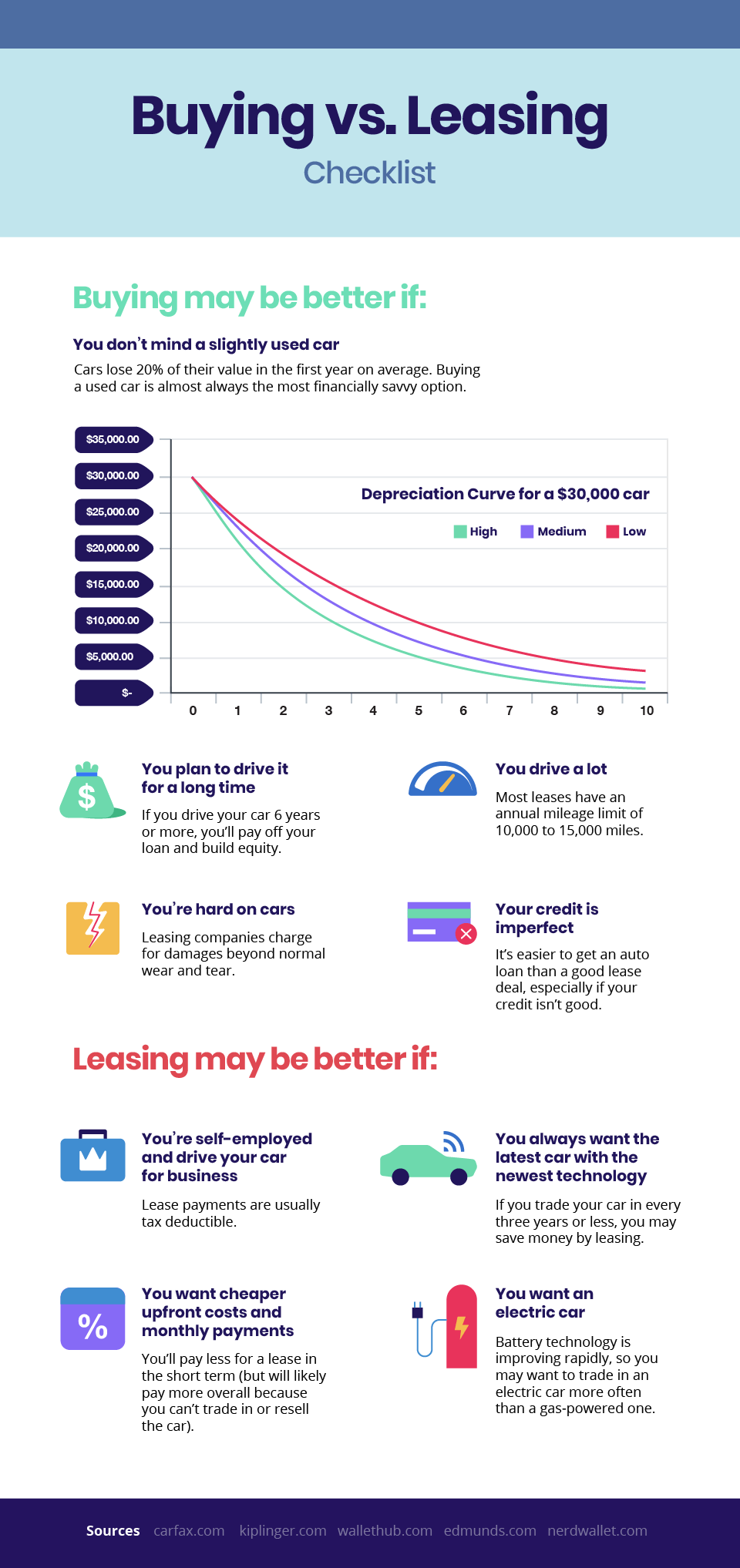

0 Down 160month Deals Near Your Zip. You can deduct costs you incur to lease a motor vehicle you use to earn income. Enter the total lease payments deducted for the.

If youre an Armed Forces reservist a qualified. Ad Request a Lease Quote on Any Auto. Get Low Leases on Selected Makes Models.

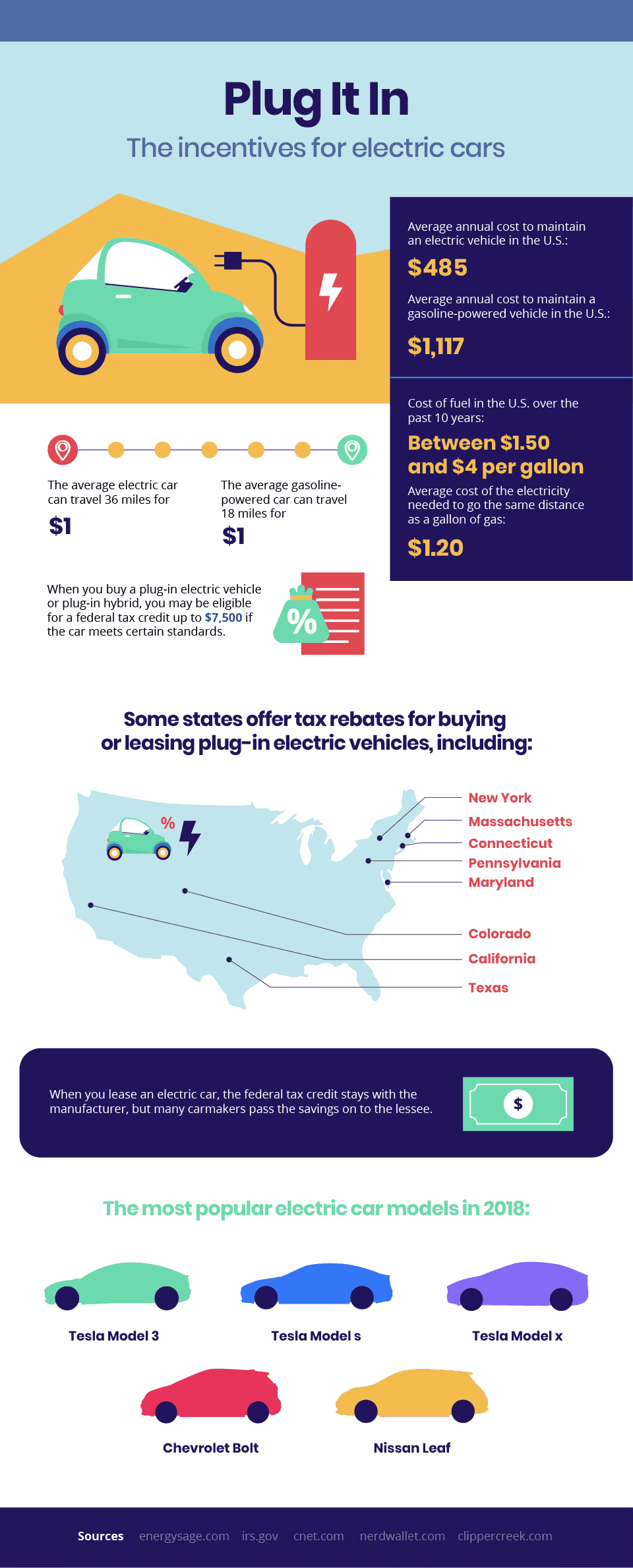

The IRS includes car leases on their list of eligible vehicle tax deductions. If you expect to be leasing a car soon you may also be able to deduct the sales tax on your new car lease the only states with no sales tax are Alaska Delaware Montana New Hampshire or. Enter the value that a dealer is giving you for your current vehicle.

As previously mentioned business leasing can provide considerable tax benefits. Premium federal filing is 100 free with no upgrades for premium taxes. Lease Buy or Finance New Cars.

Chart to calculate eligible leasing costs for passenger vehicles. When trading in a. Deduct your self-employed car expenses on.

You can claim back up to 50 of the tax on the monthly payments of your lease up to 100 of the tax on a. If youre in a 25 tax bracket. Ad Free tax filing for simple and complex returns.

This is the total selling price of the car before taxes. Enter the total lease charges payable for the vehicle in the tax year. Vehicle Cost 80000 x 60 48000.

Include these amounts on line 9281 Motor vehicle expenses not including. To calculate your eligible leasing costs fill in Chart C Eligible leasing cost for passenger vehicles of your form. Total deduction 52200.

His total deduction in 2021 are. For vehicles first leased in 2021 the threshold is 51000. Schedule F Form 1040 Profit or Loss From Farming if youre a farmer.

This income inclusion rule is an attempt to equalize the tax benefits from leasing and owning business vehicles. The calculator will estimate the. Total Pre-Tax Selling Price.

If youre a self-employed person or a business owner who drives for work your lease is fair game.

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Depreciation Cost Residual Value Useful Life Depreciation Book Value X Depreciation Rat Business Tax Deductions Business Tax Accounting Principles

Depreciation Cost Residual Value Useful Life Depreciation Book Value X Depreciation Rat Business Tax Deductions Business Tax Accounting Principles

Potential 2020 Business Vehicle Tax Deduction Bismarck Motor Company

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Tax Deductions Business Tax Deductions Deduction

Writing Off A Car Ultimate Guide To Vehicle Expenses

Section 179 Tax Deduction Port Orchard Ford

Is It Better To Buy Or Lease A Car Taxact Blog

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Is It Better To Buy Or Lease A Car Taxact Blog

Maximizing Tax Deductions For The Business Use Of Your Car Business Tax Deductions Tax Deductions Small Business Tax Deductions

Real Estate Lead Tracking Spreadsheet

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

How Is Car Lease Tax Benefit Calculated In India For Individual Salaried Employee Who Uses The Car For Both Official And Personal Purpose Can You Explain With An Example Quora

Solved Sales Tax Deduction For Leased Car Personal Use

All About Mileage June 1 2018 Levesque Associates Inc Mileage Small Business Owner Business Owner

Generate Rent Receipt With All India Itr Income Tax Income Tax Return Tax Refund